Yesterday my darling looked straight into my eyes and said: “Next year, I am going to invest in cryptocurrency”. The way she said so seriously made me unable to refuse. I spent all night telling her my knowledge regarding blockchain, consensus, byzantine, and asymmetric cryptography… and realized one night is not enough. So I decided to write this series so she can read them many times

and not get rekt when investing.These entries focus on the fundamentals of blockchain, and cryptocurrency that help you understand what it is in the easiest way.

Now, game on!

Cryptogrtaphy - History

Cryptography is not something strange to everyone.

When I was little, my friend sent me a letter from the beginning of class to the end of class written in a strange character that only I could understand. In the war, all sides encode their message to ensure their tactics are always secure until the last minute. All of those are cryptography.

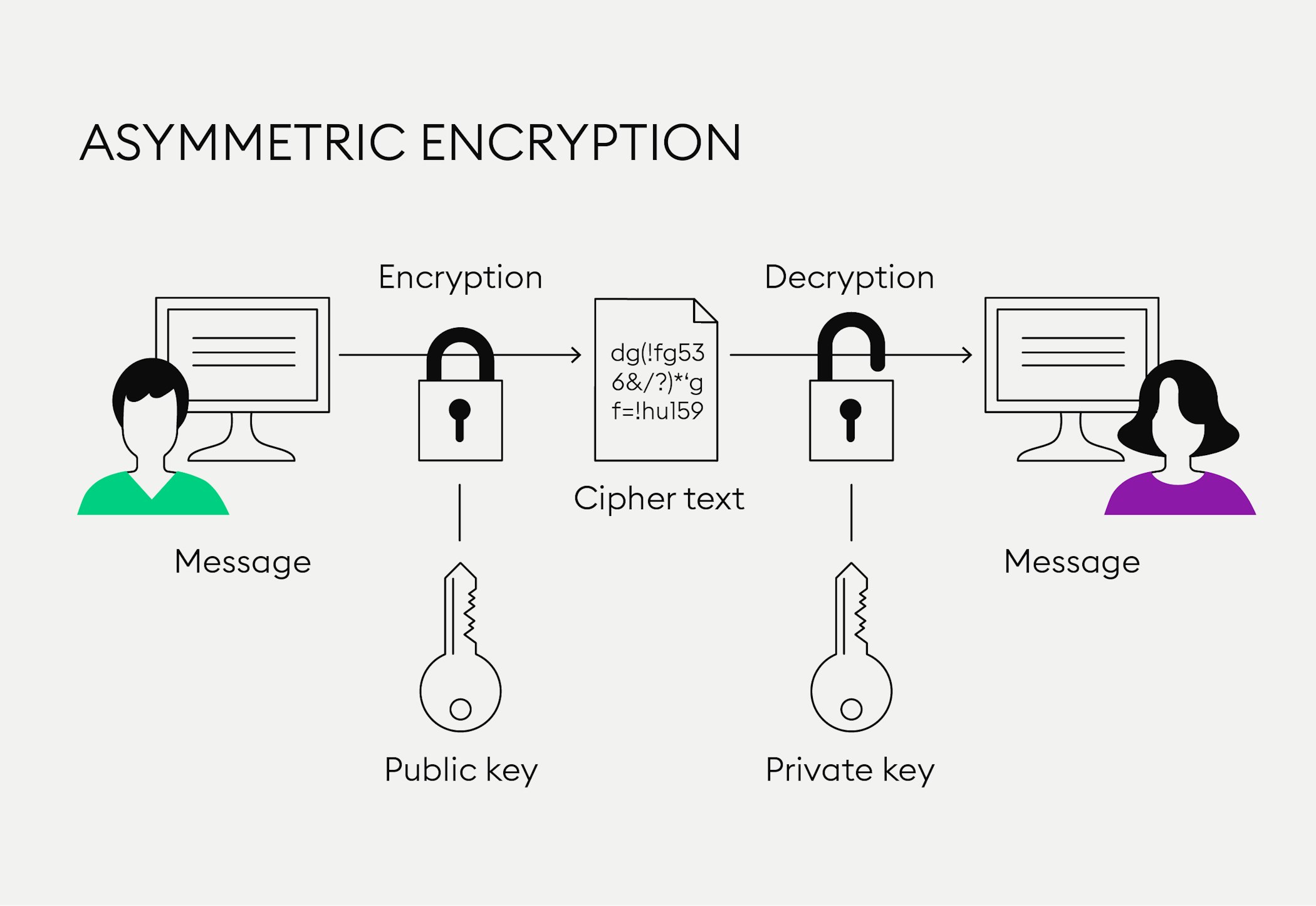

Back to 1976, was the year that marked the birth of Asymmetric Cryptography and has existed until now. They use two mathematically related keys: private-key and public-key. The Private key is something that only we have, and cannot be shared with anyone, while the Public key is what we will use to send to the partner.

Figure 1: How Asymmetric cryptography works

Figure 1: How Asymmetric cryptography works

Asymmetric Cryptography is considered the heart of blockchain in general or Bitcoin in particular today. Because it helps keep information safer from those who want to attack.

Based on those encryption methods, many Cryptographic Digital Currencies have been researched before but all failed. These include:

- DigiCash (David Chaum) - 1989 1

- Mondex (National Westminster Bank) - 1993 2

- CyberCash (Lynch, Melton, Crocker & Wilson) - 1994 3

- E-gold (Gold & Silver Reserve) - 1996 4

- Hashcash (Adam Back) - 1997 5

- Bit Gold (Nick Szabo) - 1998 6

- B-Money (Wei Dai) - 1998 7

- Lucre (Ben Laurie) - 1999 8

One of the above innovations was later used and developed by Satoshi Nakamoto in 2008 to create Blockchain and was realized the following year as a core part of Bitcoin.

Blockchain and utility

Blockchain is a decentralized database that stores information in blocks of information that are linked together by encryption and expand over time. Each information block contains information about the initialization time and is linked to the previous block, along with a time code and transaction data (Figure 2). Blockchain is designed to be resistant to data alteration: Once data has been accepted by the network, there is no way to change it.

Figure 2: Data on Blockchain

Bitcoin and utility

Bitcoin can be simply understood as the first complete digital currency using blockchain technology.

Bitcoin was originally born to solve the problem of e-commerce. E-commerce must rely almost entirely on a trusted third party - financial institutions - to process electronic payments.

This system works quite well for most transactions, but it still has the inherent weaknesses of the trust model. Implementing irreversible transactions based on this model is not really feasible, as intermediary disputes are inevitable when using financial institutions. I ntermediary fees increase transaction costs, making it unfeasible to carry out routine small transactions and incur higher costs due to the inability to make irreversible payments for irreversible cases.

Because of the possibility of reversal, the need for trust between parties increases. Merchants must be cautious with their customers, bothering customers for more information than is really needed. Fraud is seen as unavoidable, and people have to accept living with a certain percentage of fraud. Cash transactions avoid the above costs and risks, but currently, no system exists to ensure payment through a communication channel without the need for a third-party intermediary. So what we need is an electronic payment system that is built on cryptographic proof rather than trust, which allows two parties to transact directly with each other without any third parties.

With Bitcoin, each owner sends the coin to another by digitally signing a hash of the previous transaction and the next owner’s public key then adding them to the last information of the coin. The recipient can verify the signatures to confirm the ownership. (Figure 3)

Figure 3: How Bitcoin works

Figure 3: How Bitcoin works

However, the problem here is that the recipient of the coin cannot confirm whether one of the holders is cheating by double spending their coins (Using the same coin for many different expenses). The solution that Satoshi Nakamoto proposed was to only count the first transaction and ignore all subsequent double-spend transactions.

The only way to confirm a false transaction is to identify all transactions on the system. To do that without a third party, all transactions must be made public. The recipient needs proof that, at the time of each transaction, a majority of nodes agreed that the transaction was first.

That leads to a game, a game theory for Bitcoin:

- Bitcoin creates a challenge, the game starts and there is a race between miners.

- These challenges usually take about 10 minutes to complete

- Each miner tries to find a solution that matches the block’s hash

- At each specific point, the one with the fastest will win that race

- Now, the rest of the community is going to verify that block was mined by the previous winner. This makes Bitcoin strong because miners compete every cycle. After verification, it will be added to the Blockchain.

- For each of these tasks, the winner will be rewarded with new Bitcoin generated in the system, this reward will become less and less until one day it will not be generated anymore (when the market reaches 21 million BTC) causing Bitcoin to never inflation.

View the next entry Blockchain 101 \ 2 - Terminology